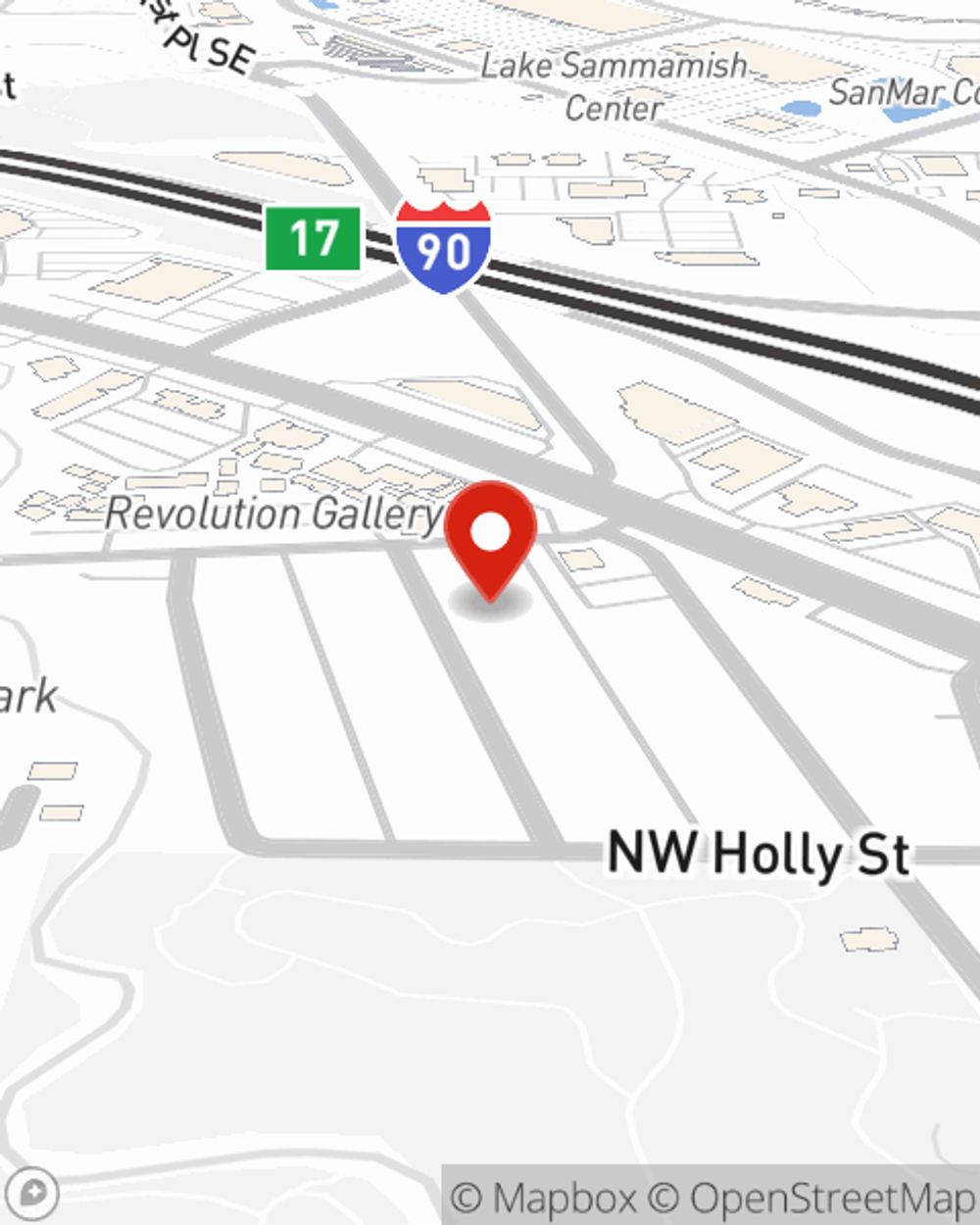

Renters Insurance in and around Issaquah

Your renters insurance search is over, Issaquah

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Bellevue, WA

- Renton, WA

- Maple Valley, WA

- Sammamish, WA

- North Bend, WA

- Renton Highlands,wa

- Snoqualmie, WA

- Redmond, WA

- Preston, WA

- Medina, WA

- Newcastle,wa

- Fall City, WA

- kirkland,wa

- Kent, WA

- Carnation, WA

- black dimond,wa

- Seattle, WA

- Mercer Island, WA

- Hobart, WA

- federal way, wa

- auburn,wa

- bothell,wa

- woodinville,wa

- lynnwood,wa

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - utilities, outdoor living space, furnishings, condo or townhome - getting the right insurance can be important in the event of the unexpected.

Your renters insurance search is over, Issaquah

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

When the unexpected abrupt water damage happens to your rented condo or townhome, generally it affects your personal belongings, such as an entertainment system, a video game system or a desk. That's where your renters insurance comes in. State Farm agent Aaron A. Hakobian is dedicated to help you evaluate your risks so that you can insure your precious valuables.

Renters of Issaquah, State Farm is here for all your insurance needs. Get in touch with agent Aaron A. Hakobian's office to get started on choosing the right policy for your rented property.

Have More Questions About Renters Insurance?

Call Aaron A. at (425) 392-2999 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Aaron A. Hakobian

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.